Overseas Income Tax Calculator

Generally when your non singapore citizen employee i e.

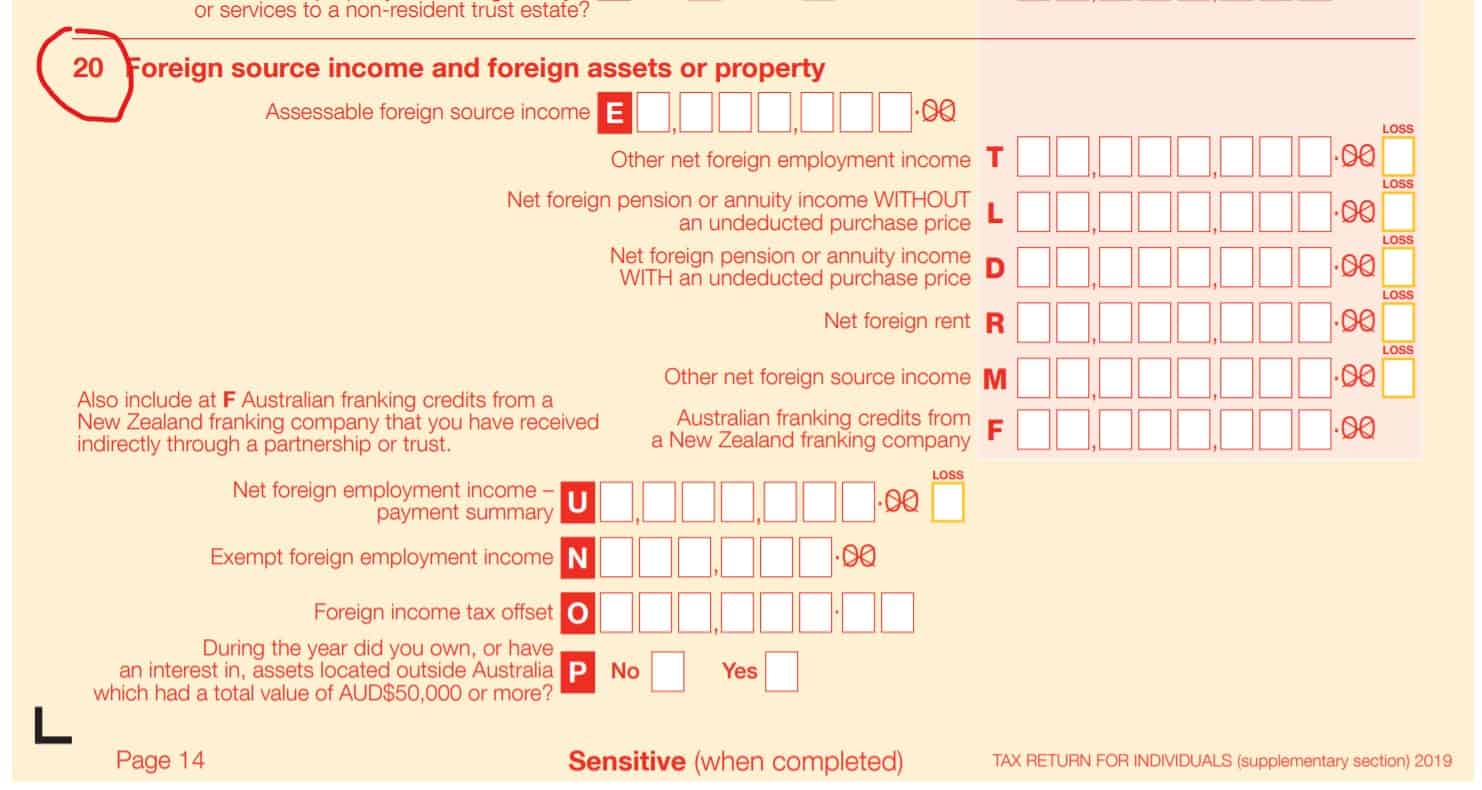

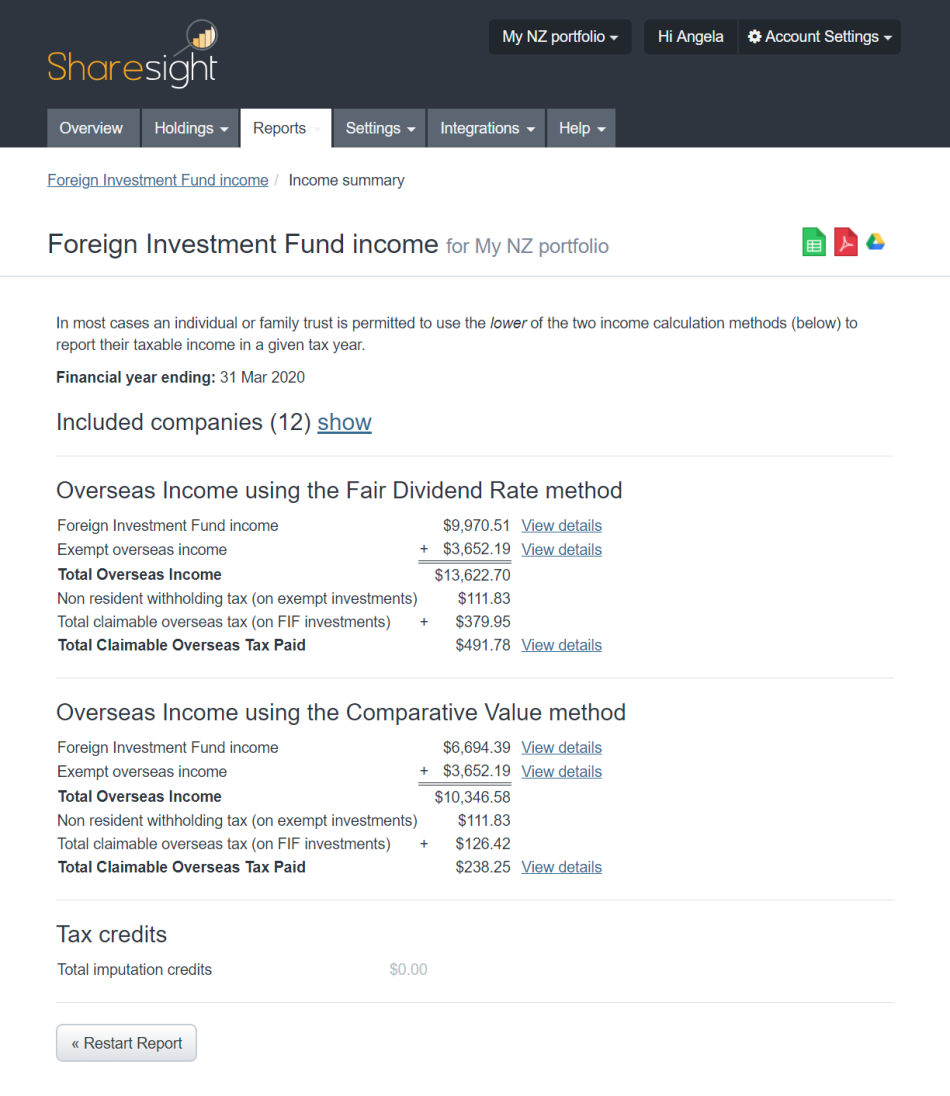

Overseas income tax calculator. All types of income are treated the same for the purposes of working out the foreign income tax offset. Use the foreign earned income tax worksheet in the form 1040 instructions. Parenthood tax rebate eligibility tool xls 362kb. Compute income tax liability for tax resident individuals locals and foreigners who are in singapore for 183 days or more 2.

For tax year 2019 the maximum foreign earned income exclusion amount was the lesser of the foreign income earned or 105 900 per qualifying person. The foreign income conversion calculator will convert your foreign income into australian dollars. It can be used for the 2013 14 to 2019 20 income years. Foreign or singapore permanent resident employee ceases employment with you in singapore goes on an overseas posting or plans to leave singapore for more than three months you are required to seek tax clearance for him.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. Include income that s already been taxed abroad to get foreign tax credit relief if you re eligible. Figuring the tax if you qualify for and claim the foreign earned income exclusion the foreign housing exclusion or both must figure the tax on your remaining non excluded income using the tax rates that would have applied had you not claimed the exclusion s. As an employer you have the responsibility to file the form ir21 and withhold all monies due to the employee for.

The conversion rate you provide. Foreign income conversion calculator. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. Use the foreign section of the tax return to record your overseas income or gains.

The calculator can use. Rental calculator for tax resident and non resident individuals xls 362kb compute rental income for tax resident and non resident individuals. You need to declare foreign interest source code 4218 in the investment income section of your tax return together with the foreign tax credit source code 4113. Foreign rental income if you own property overseas and are receiving an income by renting your property out abroad then this classifies as foreign rental income which is taxable for all south african residents.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. See converting foreign income to australian dollars. Since you are excluding 105 900 of your 150 000 gross receipts you will need to multiply that same ratio by the expenses that are directly related to your schedule c gross receipts as follows.

.jpg)