Pension Lump Sum Calculator Final Salary

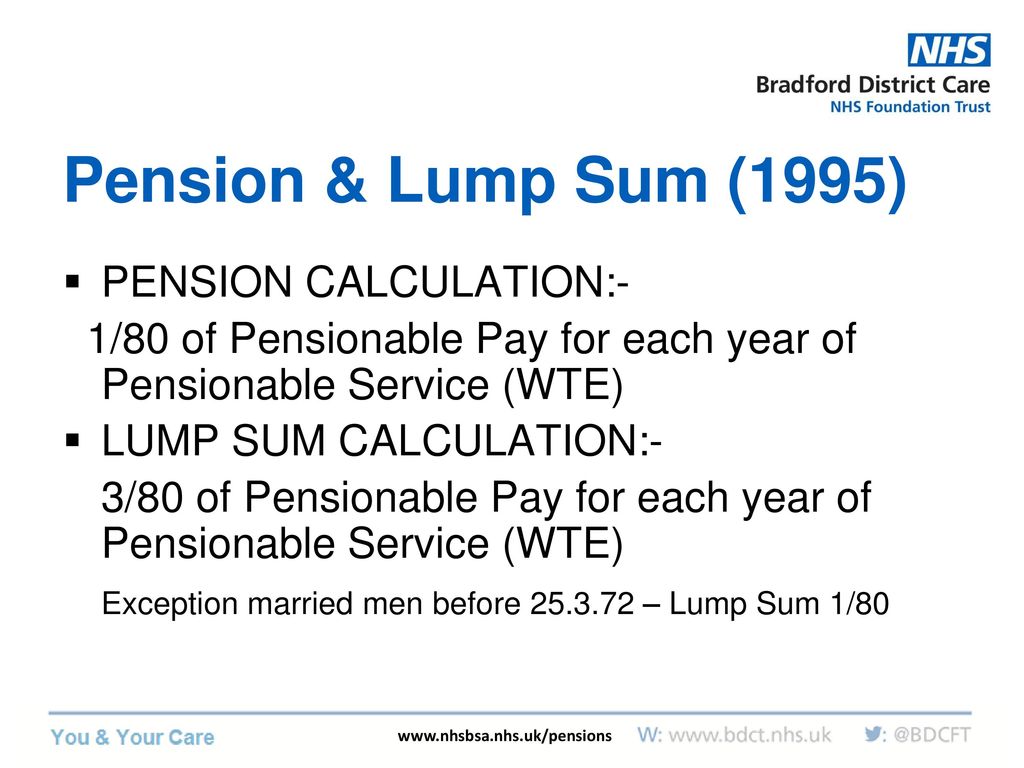

A lump sum equal to three times your pension.

Pension lump sum calculator final salary. The lump sum is currently tax free provided it does not exceed one quarter of the standard lifetime allowance. How much you can take out of your defined benefit pension and how this will affect your final pension allowance is a complex calculation but it s based on a commutation factor. It s a microsoft excel file and covers the needs of most members of the 1995 section the 2008 section and the 2015 scheme as well as members who have benefits in more than one section or scheme. Can i ask what you would do please.

So you are likely to be impacted by the 2020 21 lta if you are expecting to receive an annual income with no separate lump sum in the region of 53 650 a year. 30 000 20 80 7 500 a year 22 500 tax free lump sum. I have been offered a lump sum of 145 354 to sacrifice 6770 pa which after tax would be currently 5416 pa. How your pension is calculated.

I accept i have had to take an actuary reduction to retire at 56 but i m pondering whether to take the lump sum or not. A lump sum of three times your annual pension. Final salary pensions and commutation factors. If you re a deferred member who has left pensionable employment this calculator does not include pensions increase usually consumer price index.

For a commutation factor of 16 you d have to sacrifice 1 000 of income for every. With final salary pensions you calculate the total value by multiplying your expected annual pension by 20. With a final salary pension whilst you may be offered a cash lump sum on retirement the calculation used to determine your cash lump sum is based on the scheme s own rules and often results in you receiving less than 25 of your pension pot. If you are classified as a high earner and have certain protections you may be eligible to take more than 250 000 as a lump sum.

If your normal pension age is 60 your final salary benefits are. How does your pension build up work if your npa is 65. These benefits will be calculated with reference to your pensionable service expressed in years and days and final pensionable salary. To get a quick estimate of the benefits your nhs pension scheme will provide on any retirement date selected by you just download our handy calculator.

If average salary 30 000 and member has 20 years reckonable service then the pension will be. A pension calculated by multiplying your service by your average salary and then dividing by 80. I m planning to take my final salary pension early at 56 with a nrd of 62. Taking a pension lump sum from a defined benefit final salary pension defined benefit schemes guarantee to pay you a set amount every year in retirement normally adjusted for inflation every year.

Withdrawing a cash lump sum from your final salary pension is known as commutation. If your normal pension age is 65 your final salary benefits are.