Property Investment Trusts Uk

Uk and japanese equities pan asian equities and commercial property.

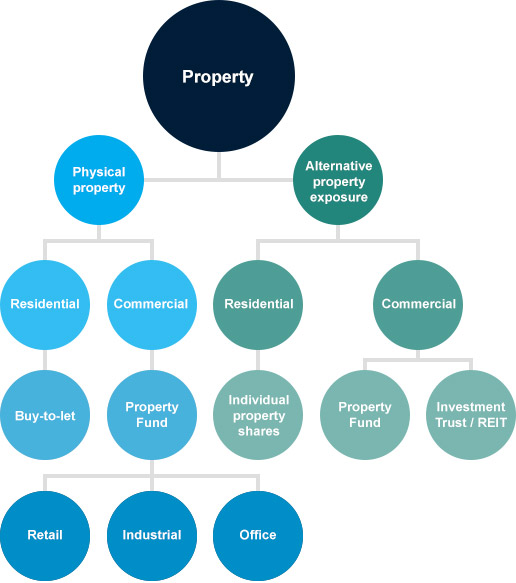

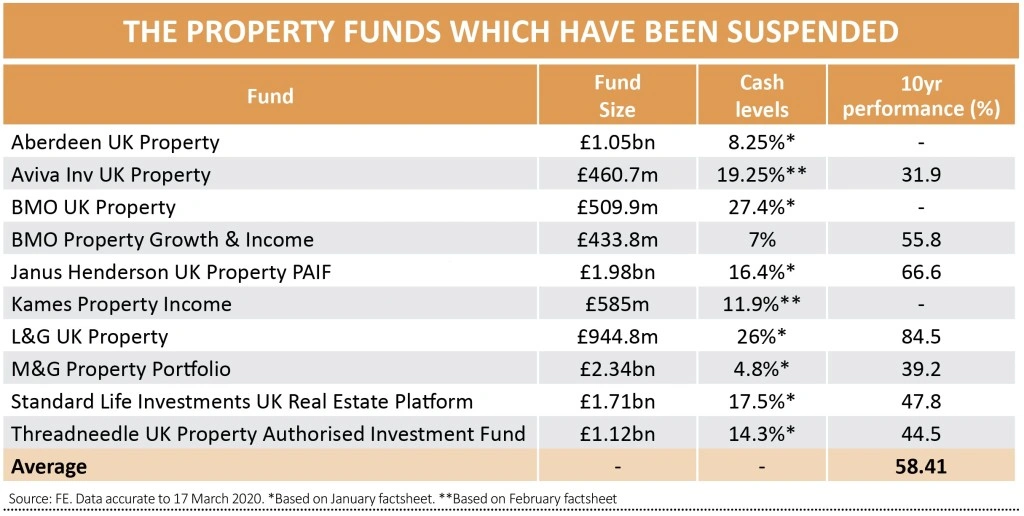

Property investment trusts uk. There are different types of trusts and they are taxed differently. A trust is a way of managing assets money investments land or buildings for people. Each trust has different aims and objectives with the option of capital growth income or a combination of both and with a specific regional focus or with a global remit. Online stockbroker bestinvest has updated its top rated funds buy list dropping bmo commercial property as one of its recommended investment trusts see table below.

A uk reit must operate as a property rental business and this can be either a uk or an overseas property investment business. Heavily discounted bmo commercial property has reinstated its suspended dividend but at just half the level it was before the coronavirus crisis. Schroders investment trusts provide investors with access to a range of nine distinctive investment opportunities including. The settlor decides how the assets in a.

Although there are concerns about what effects the uk s departure from the european union will have on uk commercial property a good actively managed fund should be able to allocate away from areas that could be negatively affected. In lieu of the usual agm presentation the investment manager posted a webcast regarding the trust s portfolio and performance that can be accessed here. The largest is tritax big box lon bbox with total assets of 2 7bn. The 468 uk real estate investment trust.

Investment trust property picks by dave baxter with offices deserted and retailers fighting to survive the coronavirus crisis has been disastrous for many property funds. At least 75 of the reits profits must be generated from its property rental activities and at least 75 of its gross assets must be assets or cash associated with its property rental activities. Commercial property has been a useful asset for diversifying away from equities and as a source of income. The new financial year ending 31st march 2021 has started strongly with the nav total return rising 11 5 against a benchmark total return of 8 1.

:max_bytes(150000):strip_icc()/REITFFO-e6fa87094ecc4964be6620a042ec685c.png)