Purchase Rate Credit Card Explained

Interest rates are different for different uses of your card.

Purchase rate credit card explained. The applicable terms and conditions describe how interest is applied on a credit card account. Different interest rates are charged depending on the type of transaction. If you use your card to buy something in a shop you will get charged a certain rate of interest. If you withdraw money from a cash machine using your credit card you will get charged a different usually higher rate of interest.

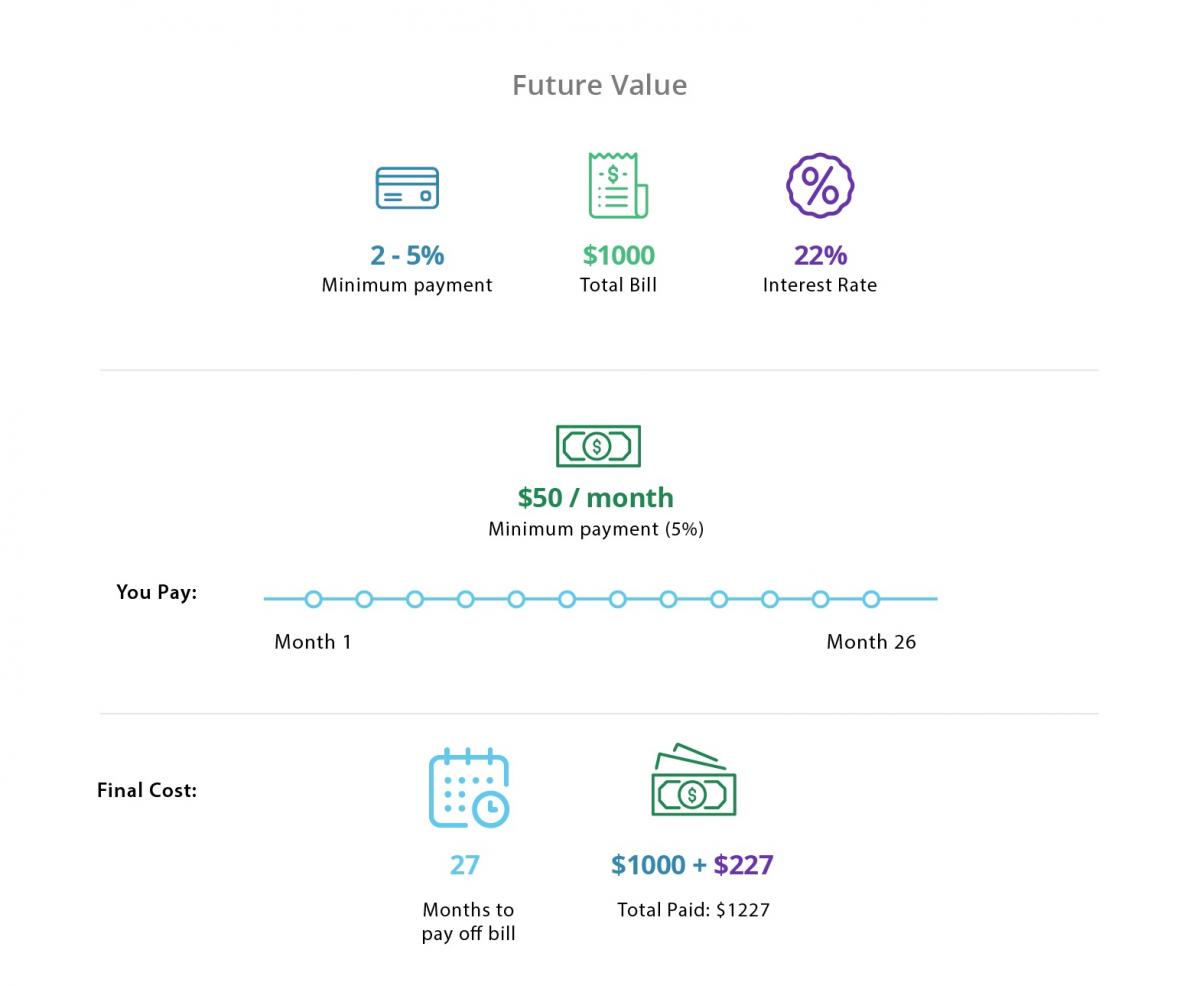

If you re going to get a credit card cash advance it s best not to use a typical rewards credit card but a low interest credit card with a low cash advance rate. The apr on a credit card is an annualized percentage rate that is applied monthly. Periodic interest rates. This is known as the purchase rate.

Credit cards work by giving cardholders access to credit to make purchases transfer balances and sometimes earn rewards when the loan is repaid in full each month. You have too many cards. Credit cards also have a periodic rate which is really just another way of stating the regular apr for a period of time less than a year the periodic rate for monthly interest for example is simply the apr divided by the number of months in the year. Withdrawing cash on your credit card will usually incur a higher rate of interest the cash advances rate.

The interest rate applied to purchases made with a credit card. The annual percentage rate differs from product to product and different rates can be applied to the different types of transactions. Unless you pay off the balance in full each month you will be charged interest on the value of purchases made with the card. For example if the advertised apr on a credit card is 19 an interest rate of 1 58 of the outstanding balance.

The purchase rate only applies to balances that are not paid in full by the end of the billing cycle with the rate. When you think of credit card interest rates you re probably thinking of the purchase rate the interest you ll need to pay on typical credit card purchases made in store or online. If you want to book a holiday for example or your washing machine suddenly breaks using a credit card. If you find yourself unable to juggle a large number of credit cards that you might have accrued over time such as store cards or other specialized credit cards you might consider canceling a few.

If a credit card you own has an annual fee but you rarely use the card for purchases you might consider canceling that card to avoid paying needless fees.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

/cropped-image-of-woman-hand-holding-credit-card-while-making-payment-in-cafe-1010583280-57bb21c3ee4a4b9bb6553263c08f66e0.jpg)