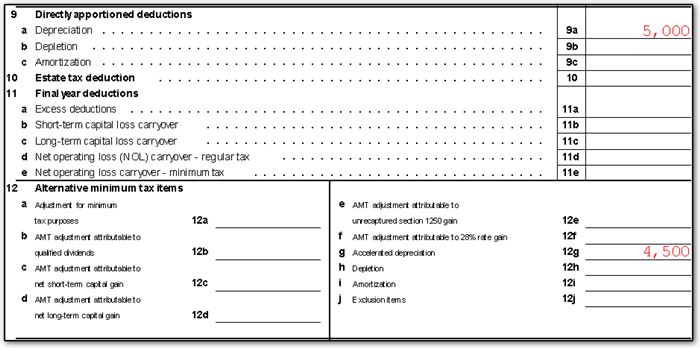

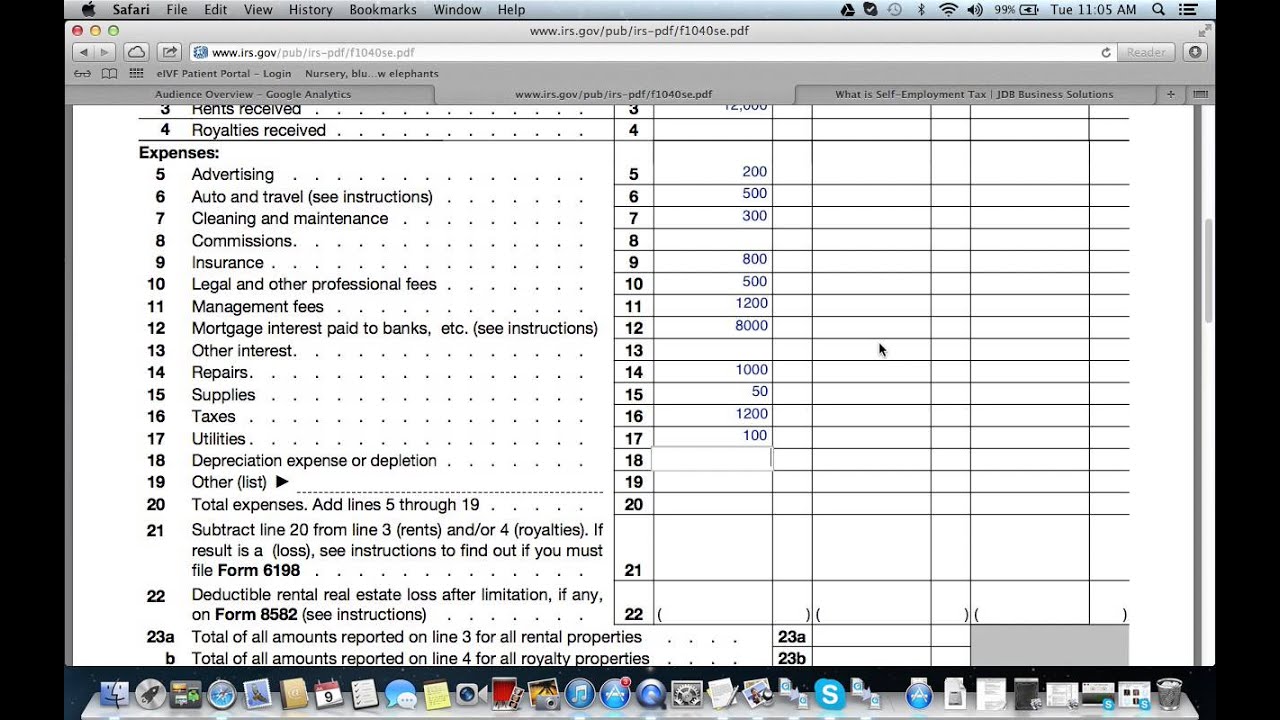

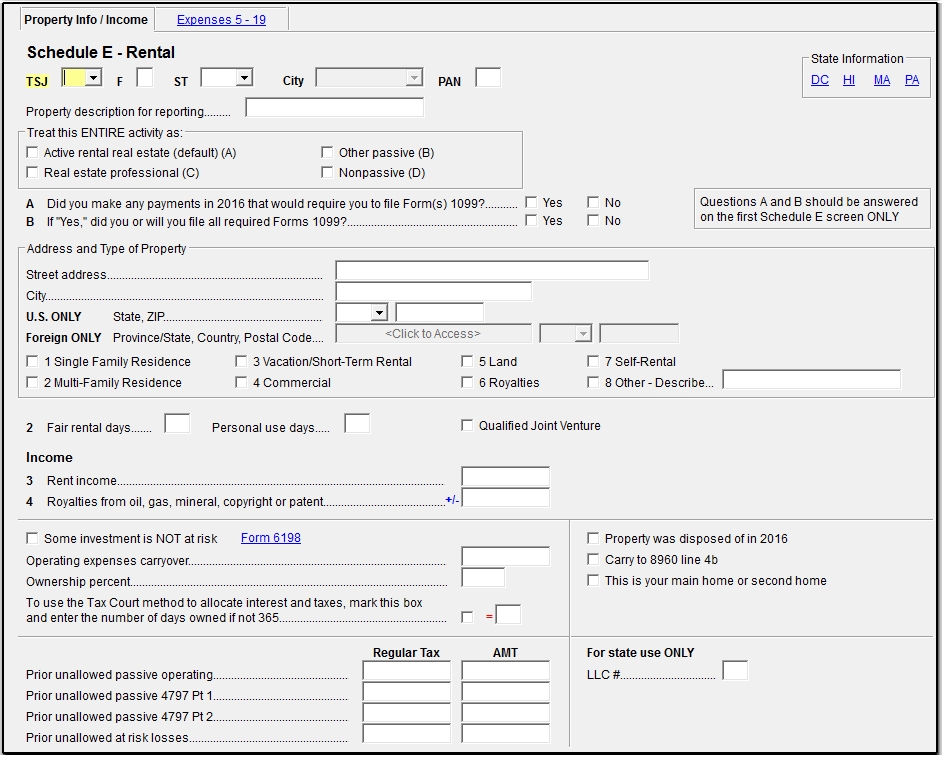

Schedule E Allowable Expenses

You can generally use schedule e form 1040 or 1040 sr supplemental income and loss pdf to report income and expenses related to real estate rentals.

Schedule e allowable expenses. Entertainment expenses incurred on meals with colleagues expenses incurred for meeting potential clients payment in lieu of notice paid to employers for failing to serve sufficient notice period before leaving a job. Flat rate expenses 2020 2019 2018. If the expenses are from a passive activity and you are not required to file form 8582 enter the expenses related to a passive activity on a separate line in column f of line 28 of the schedule e. Do not combine these expenses with or net them against any other amounts from the partnership.

Expenses that are capital in nature e g. Expenses have to be related to your business operations. Use schedule e to itemize the expenses associated with your rental property. You can list up to three properties on a single schedule e.

Cutters dispatchers rulers 150 150 150 150 150 warehousemen 90 90 90 90 90 professional valuers in the valuation office radiographers radiation therapists a where obliged to supply and launder their own 680. Allowable business expenses can reduce the amount of tax you have to pay as it can be claimed as a deduction against your business income. However there are general rules set by iras regarding the allowable expenses that can be claimed. Expenses should be supported by proper and complete source documents that should be kept for at least five years to substantiate your claims.

If you provide substantial services that are primarily for your tenant s convenience report your income and expenses on schedule c form 1040 or 1040 sr profit or loss from business sole proprietorship pdf. Up until 2003 such expenses were known as schedule e expenses and many still refer to them as such even though schedule e no longer exists. Purchase of fixed assets such as plant and machinery are not allowable business expenses. However you should also understand that there are certain rental expenses you may deduct on your tax return on schedule e if you receive rental income.

Enter the amount from schedule k 1 form 1065 box 14 code a on schedule se after you reduce this amount by any allowable expenses attributable to that income. These expenses are allowed against the earnings received by the contractor who is a director or an employee of a company whether it is their own company or an umbrella company continues hill. If you own more properties attach as many schedule e forms. If you own rental real estate you should be aware of your federal tax responsibilities.

Foreign partnerships follow the instructions below in addition to the instructions earlier for domestic partnerships.

/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)