Setting Up A Trust Fund To Avoid Inheritance Tax

The trustees will be liable to pay the.

Setting up a trust fund to avoid inheritance tax. The assets in the trust are set aside just for bereaved minor they become fully entitled to the assets by the. In reality you would never set up a trust just to gain tax advantages. Trust funds 101. Setting up a trust fund to avoid inheritance tax trusts are generally legally referred to as settlements.

They re set up by the ultra. Setting up a basic trust might have minimal cost. There are several types of trust. This is levied on the current value of the assets after deducting the 325 000 inheritance tax allowance.

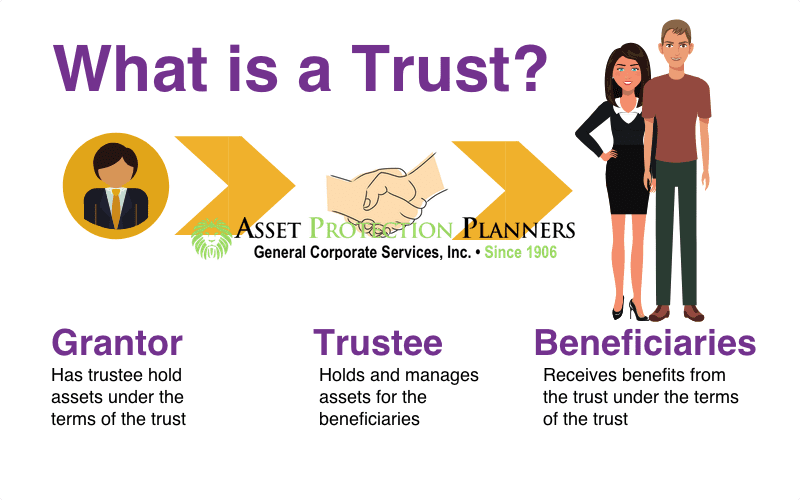

When you set up a trust you are giving up ownership of the assets it holds. The trust is irrevocable because in the future you wouldn t be able to make adjustments to it without the consent of the trust s beneficiary. This type of discretionary trust does not allow the settlor access to any of the trust funds so lisa would not be able to benefit in any way. If they did and they paid inheritance tax at that time the tax will be recalculated at 40 and a credit allowed for the tax paid when the trust was set up.

If lisa was included as a beneficiary then the value of the trust would be included in her estate. How to set up a trust fund in the u k. You d essentially be setting up a trust and transferring the ownership of it to another person. Where a trust is set up for a bereaved minor there are no inheritance tax charges if.

Whilst others are more complex to set up and would require more specialist advice resulting in a more substantial cost. Trusts are occasionally seen as devices to avoid paying tax. If you ve heard of trust funds but don t know what they are or how they work you re not alone. This is a dramatic move and will normally only make sense if you have clear objectives about what you want to achieve with your assets.

If lisa died in the first seven years then this trust would claim 325 000 of her standard nil rate. Changes to canadian law took away the tax advantage of setting up long term testamentary estate trusts. So if that 400 000 investment increased in value to 500 000 iht would be due on 175 000. To avoid having your life insurance proceeds taxed you can create an irrevocable life insurance trust.

Some trusts are subject to their own inheritance tax regimes.