Solvency 2 Pillar 3

General information key elements of solvency ii are the requirements relating to transparency and reports to be submitted to the supervisory authority as specified in pillar 3.

Solvency 2 pillar 3. Many features return setup for easy qrt creation in depth validations xbrl. Eiopa chairman gabriel bernardino said in his speech of 21 november 2012 that. Additional features to save time rolling forward old returns asset data imports and much more. The solvency ii disclosure requirements pillar 3 will require your business to report more information more quickly and with much greater scrutiny than ever before.

The three pillars are considered in more detail in the following sections. For example solvency ii pillar 1 shares many characteristics with the previous uk pillar 2 regime. Overview of reporting requirements under pillar 3 regular supervisory report rsr at least once in full every 3yrs private reported to supervisor solvency financial condition report sfcr annual public future regulatory reporting. Solvency ii introduces quarterly reporting and increased qualitative disclosure.

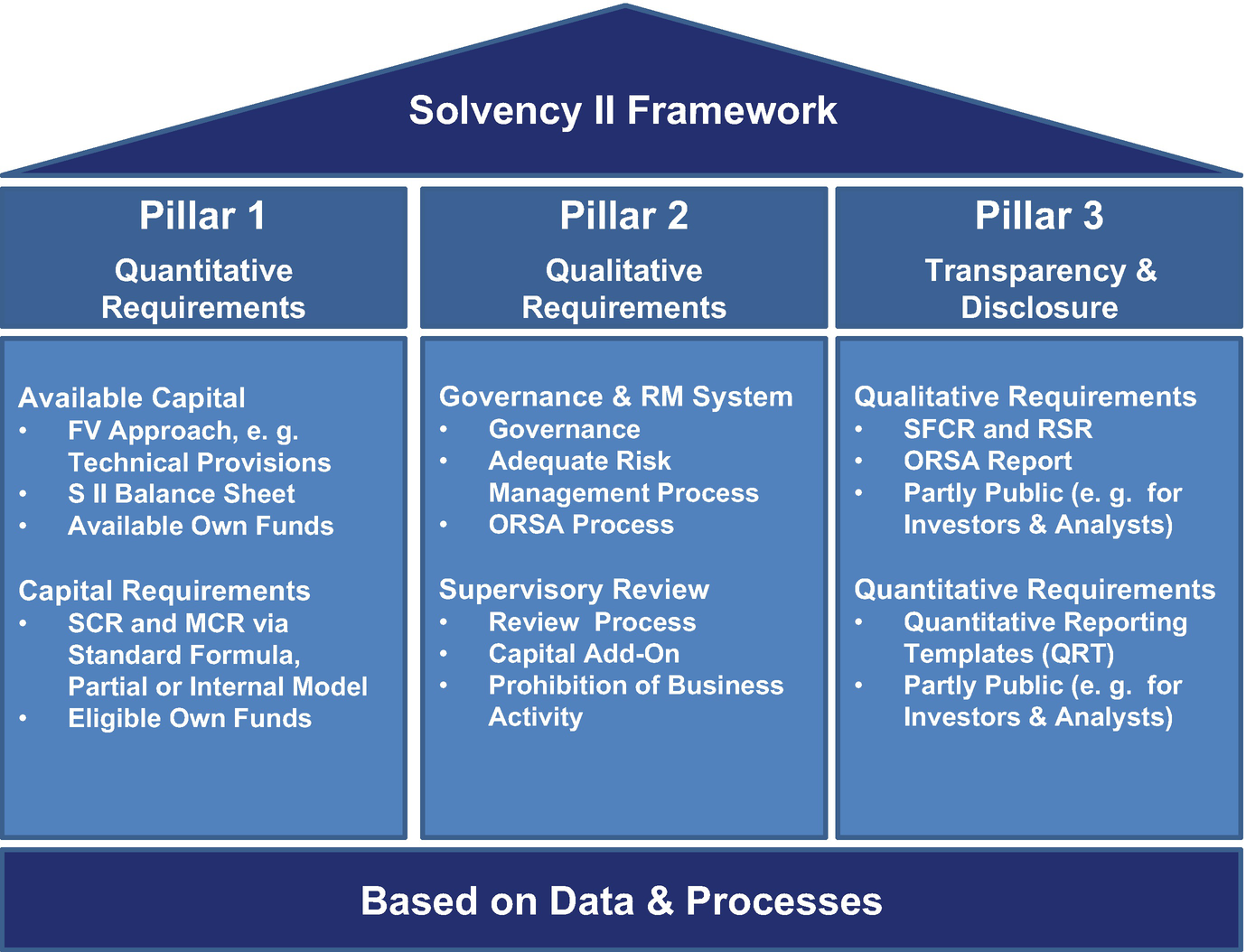

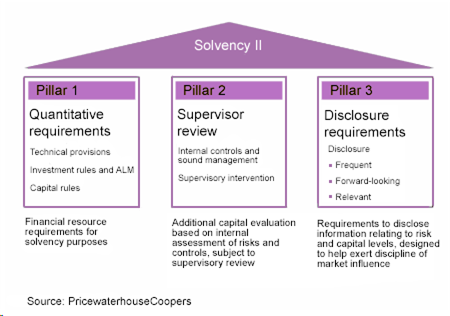

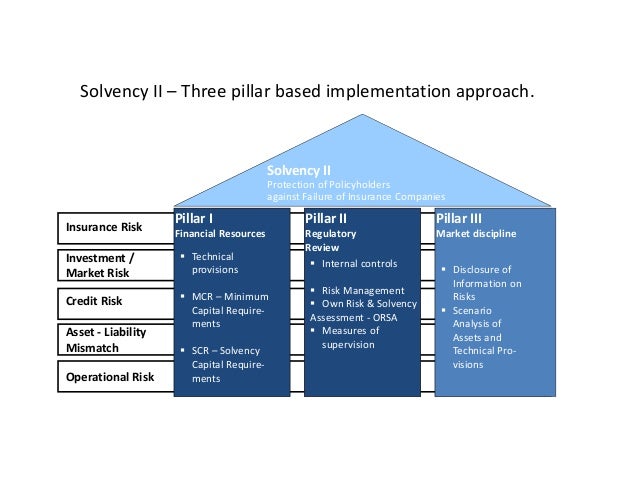

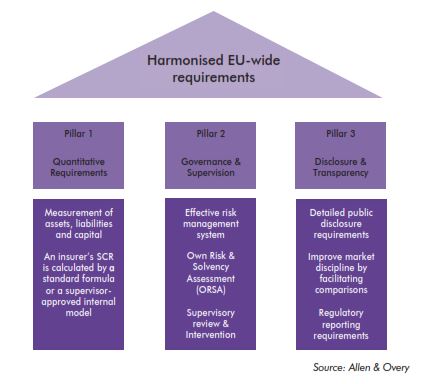

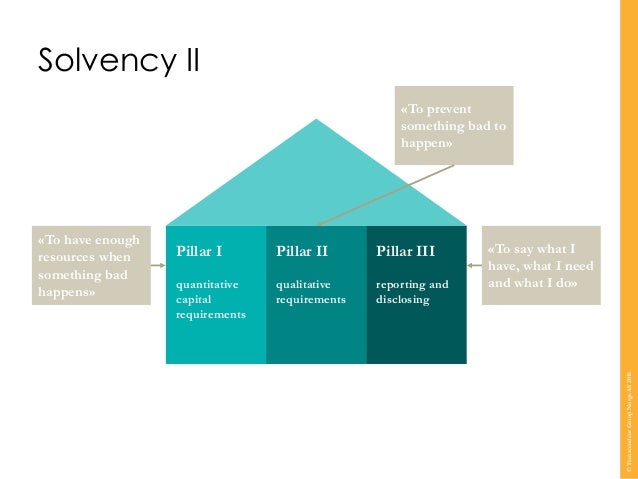

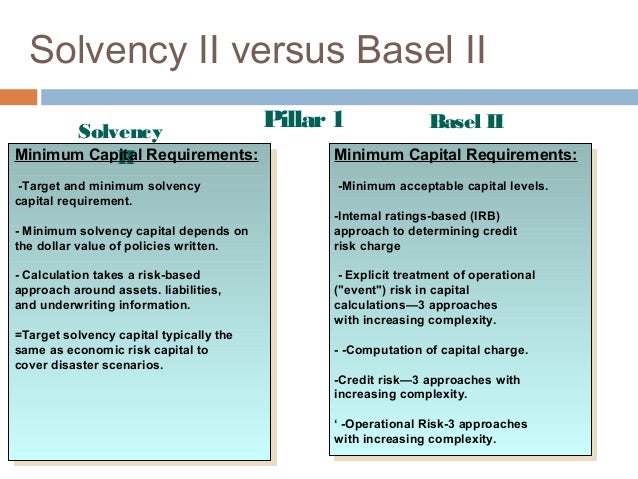

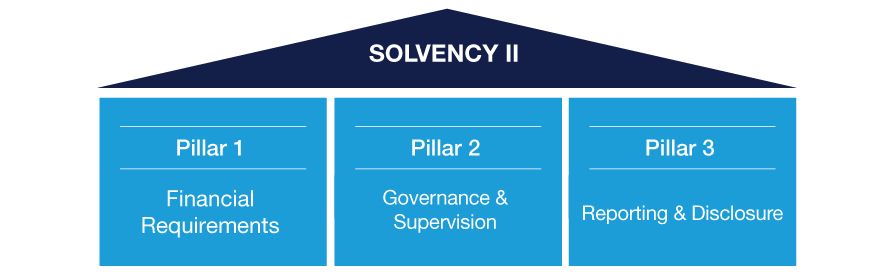

Pillar 1 consists of the quantitative requirements for example the amount of capital an insurer should hold. The tight turnaround times and level of data and analysis that need to be reported present a significant operational hurdle over and above what is required for the other two pillars. Pillar 3 of solvency ii sets out the requirements applying to public disclosures of information and supervisory reporting at both solo and group level. 1 3 pillars 1 2 and 3 the solvency ii framework consists of three pillars.

2 pillar 1 ancillary liabilities 2 1 valuation of assets. Solvency i uk regulatory regime so care may need to be exercised when referring to them. Pillar 1 covers the capability of an insurer to demonstrate it has adequate financial resources in place to meet all its liabilities and. There are separate but broadly equivalent requirements for life and health insurance business.

The proposed solvency ii framework has three main areas. The second pillar of solvency ii plans to complete the quantitative capital requirements with quality requirements and a global and appropriate risk management system. Pillar 3 focuses. This section focuses on the solvency ii requirements for non life insurance and reinsurance undertakings.

For example the proposed solvency ii framework has three main areas pillars. Pillar 2 sets out requirements for the governance and risk management of insurers as well as for the effective supervision of insurers. Solvency ii reporting software. Simple to install get up and running in under 5 minutes.