Solvency Ii Pillar 3

Pillar 3 focuses.

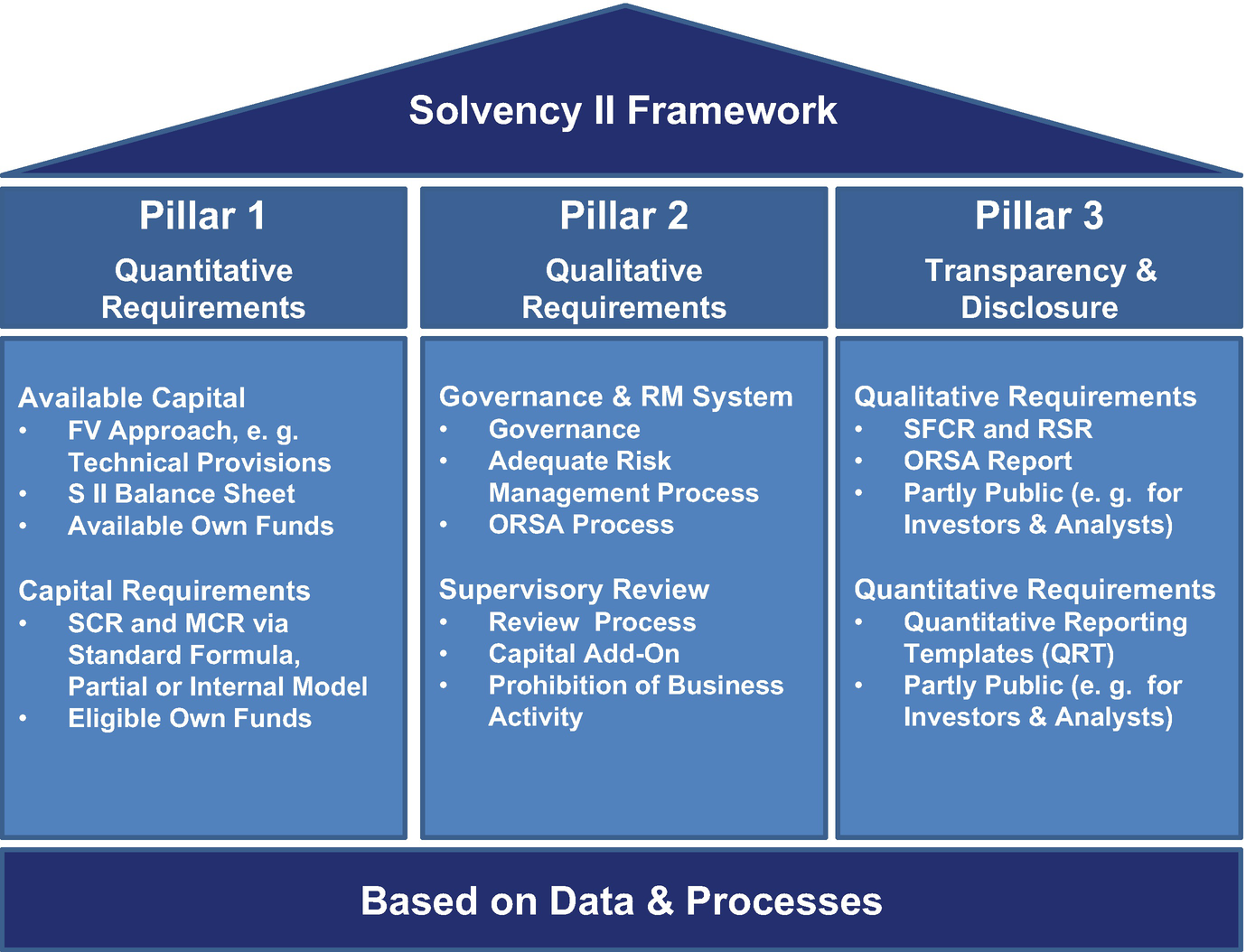

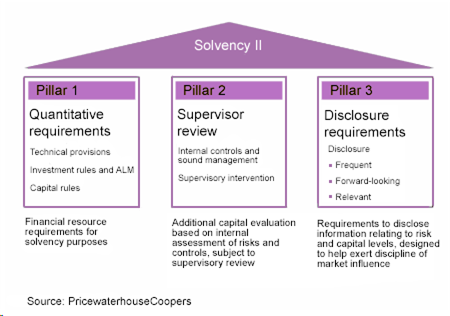

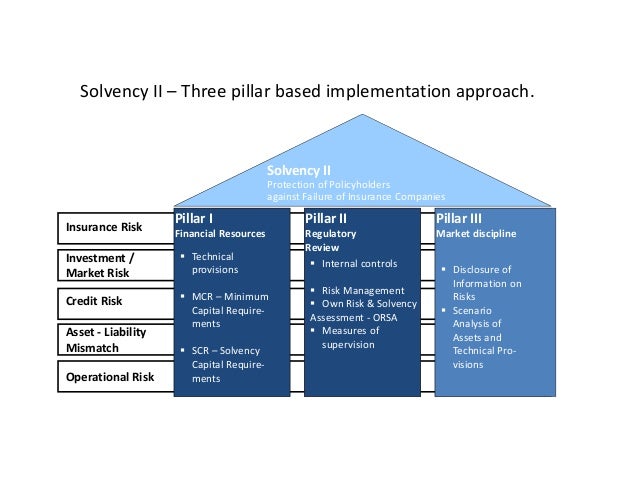

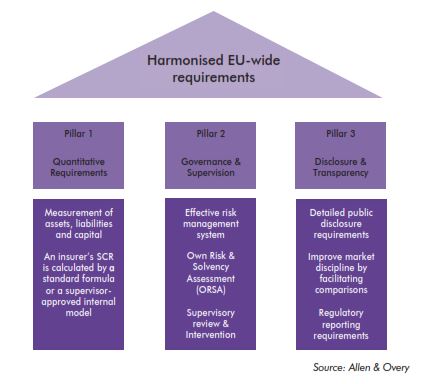

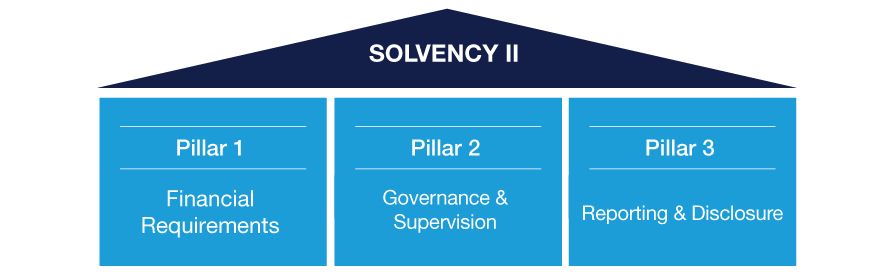

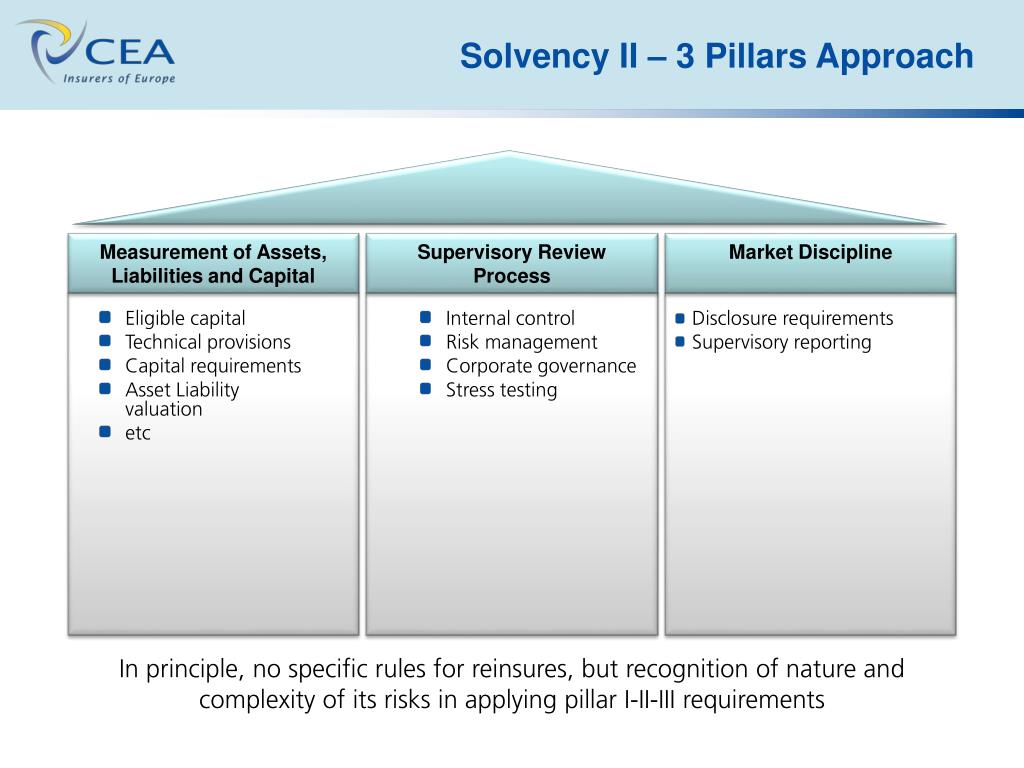

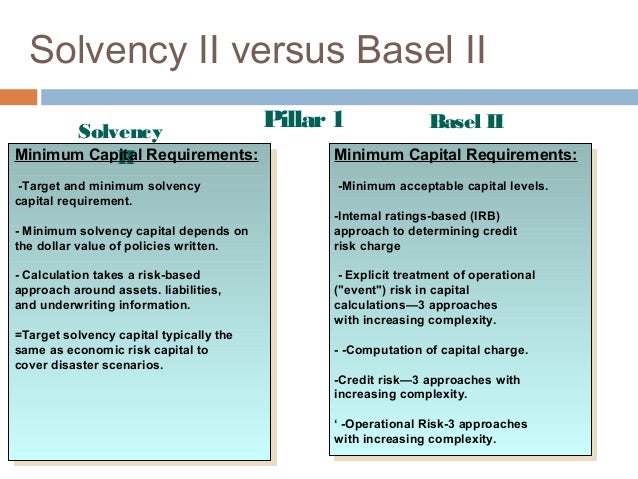

Solvency ii pillar 3. Overview of reporting requirements under pillar 3 regular supervisory report rsr at least once in full every 3yrs private reported to supervisor solvency financial condition report sfcr annual public future regulatory reporting. This includes information about ad hoc submissions. Pillar 2 sets out requirements for the governance and risk management of insurers as well as for the effective supervision of insurers. Pillar 1 consists of the quantitative requirements for example the amount of capital an insurer should hold.

See moving to a new regime. Rules not on the prescribed solvency ii format. Despite officially being introduced on saturday the quantitative aspects or everything that falls under pillar i will not come into force until april 2016 giving insurers more time to adapt to the changes. The solvency ii disclosure requirements pillar 3 will require your business to report more information more quickly and with much greater scrutiny than ever before.

The law introduces a three pillar solvency framework with pillar i based on capital adequacy and valuation pillar ii on enterprise risk management and pillar iii on market disclosure. Pillar 3 of solvency ii sets out the requirements applying to public disclosures of information and supervisory reporting at both solo and group level. General information key elements of solvency ii are the requirements relating to transparency and reports to be submitted to the supervisory authority as specified in pillar 3. Datatracks solvency ii pillar 3 reporting solution is designed to integrate relevant data from multiple sources and consolidate this into a single view for regulatory reporting.

Pillar 1 covers the capability of an insurer to demonstrate it has adequate financial resources in place to meet all its liabilities and. The bank of england has now updated the solvency ii xbrl filing manual to help firms and software vendors create xbrl instance documents for solvency ii pillar 3 reporting in light of the latest eiopa solvency ii taxonomy 2 2 0 update the bank will be adopting the taxonomy 2 2 0 hotfix. For example the proposed solvency ii framework has three main areas pillars. The proposed solvency ii framework has three main areas.

The tight turnaround times and level of data and analysis that need to be reported present a significant operational hurdle over and above what is required for the other two pillars. Reporting made simple with cloud based continuously updated and tested xbrl software.