Stable Credit Score Uk

Clearscore is not a credit reference agency.

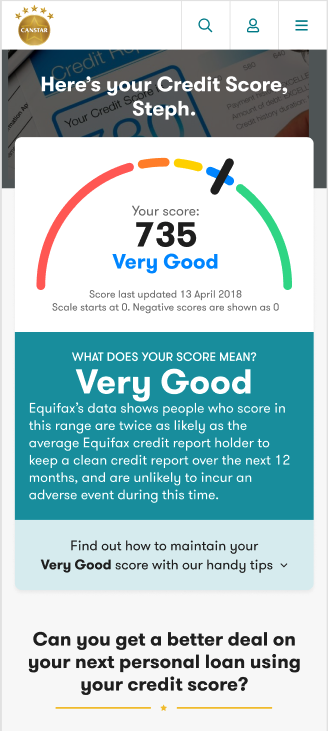

Stable credit score uk. So a good score will be good news if you re hoping to get a new credit card apply for a loan or even a mortgage. We show you your equifax credit score which ranges from 0 to 700. One score for a credit card application and a different score for a mortgage. There are three main credit reference agents that will hold information which lenders use to compile your credit score experian equifax and call credit.

A higher score means lenders see you as lower risk. A good experian score starts at 700 with 800 considered excellent. With equifax it is 660 and above. If you don t have a credit history building a great credit score from scratch can seem daunting.

There are 3 cras in the uk experian equifax and call credit. Here we ll take a look. What counts as a good credit score varies between the uk s consumer credit reference agencies. Find out what factors contribute to a good credit score with our helpful guide.

Having a uk bank account benefits your credit report in three ways. Whatever you need credit for making sure your score s good or even better excellent means you re more likely to be accepted and offered better rates. The main ones experian equifax and transunion all have their own scoring systems. A long held bank account can make you appear more stable to lenders.

Their scores range from 0 999. Cras in the uk all score consumers differently. A fair good or excellent experian credit score. A credit score is a tool used by lenders to help determine whether you qualify for a particular credit card loan mortgage or service.

They are independent organisations that obtain information about your financial behaviour from banks utilities credit card providers and other companies that have financial information about you. As a matter of fact for the most part you are regarded in the same standard as borrowers with excellent credit history with the exception that you may have a higher debt to income ratio. If your credit score is between 750 and 800 you have a long and distinguished credit history that shows a responsible payment history and the ability to handle multiple types of credit responsibly. There s no one answer.

Experian is the largest cra in the uk. A credit score of 721 880 is considered fair. The same bank may even give you a different score for when you apply for different financial products e g. A credit score is a 3 digit number that shows you how likely you are to be accepted for credit.

Using the information on your credit report and any additional information you supplied as part of your application lenders use a mathematical model to calculate a numerical score that represents your credit history.