Stocks And Shares Isa Explained

You can use all of this for a stocks shares isa if you want or you can split it between stocks shares and any of the other types of isa.

Stocks and shares isa explained. Stocks and shares isas offer the possibility of higher returns than cash isas but only if you re happy to take some risks with your savings. Everyone in the uk over 18 has an annual 20 000 isa allowance for the 2020 21 tax year ending 5 april 2021. But stocks and shares isas are riskier than cash plans. A stocks and shares isa or investment isa allows you to invest in a wide variety of investment products and are a good investment if you manage risk sensibly.

And you don t have to stick with the same isa manager each. This is known as the isa allowance. This article looks at stocks and shares isas. However you can choose to invest the full allowance in stocks and shares in cash or in a combination of the two.

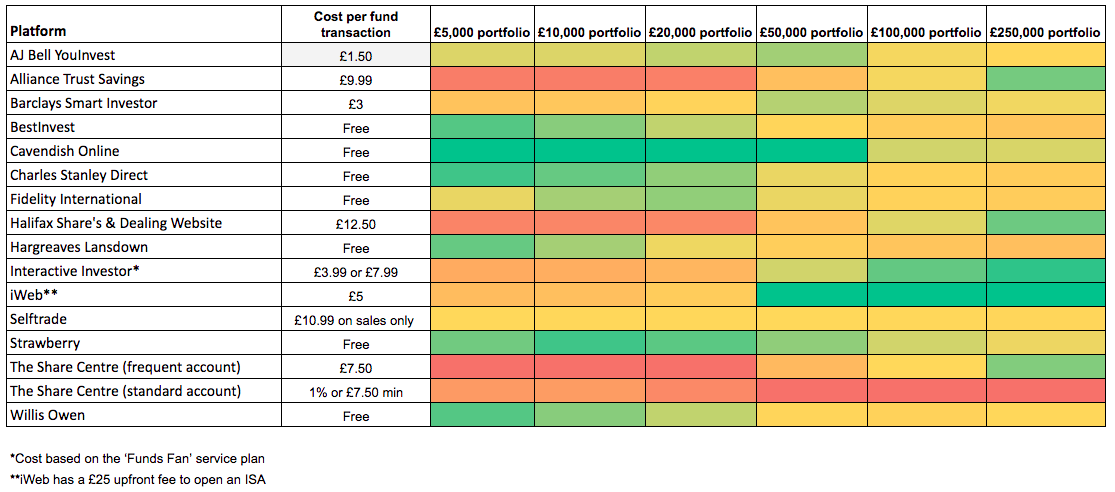

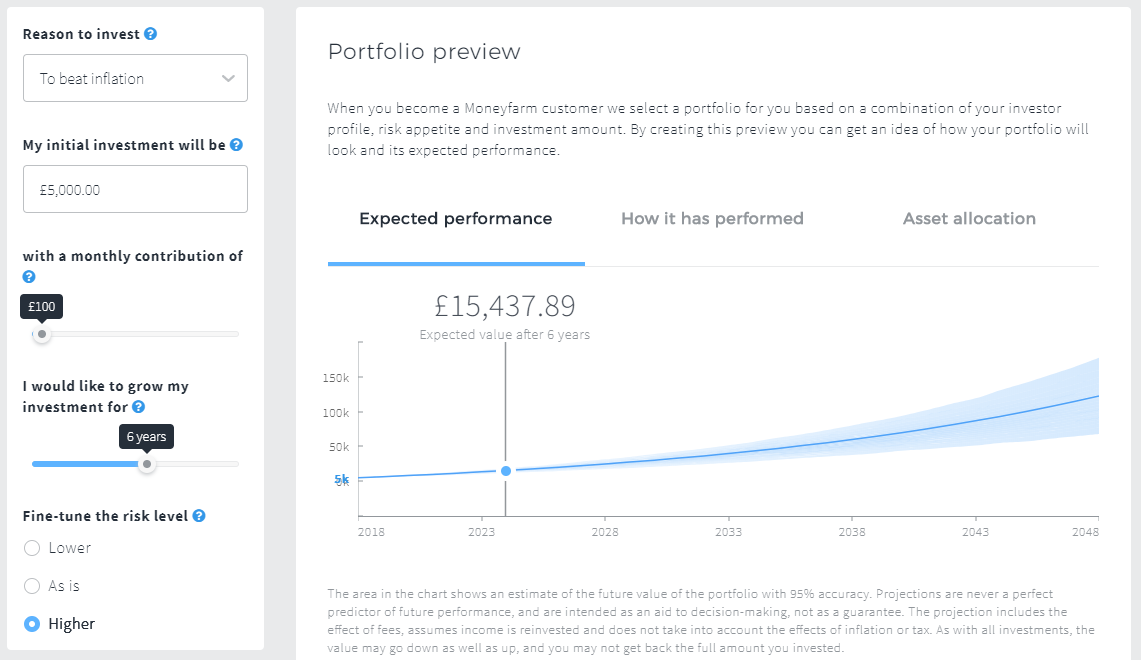

The total amount you can save in isas in the current tax year is 20 000. A stocks shares isa is very different to a cash isa which is simply a savings account. Pay in from 20 a month or a 100 lump sum. How to find the best stocks and shares isa we explain how to pick a stocks and shares isa including our recommended providers cheapest platforms and investment strategies.

We have however explained them so you can decide whether you need a stocks and shares isa. Your isas will not close when. You can pay into only one stocks and shares isa in any one tax year. Save up to 20 000 this tax year.

If you want to be more hands on try a self select stocks and shares isa. An isa is a wrapper that can be used to help save you tax. Example you could save 11 000 in a cash isa 2 000 in a stocks and shares isa 3 000 in an innovative finance isa and 4 000 in a lifetime isa in one tax year. You can also choose between making regular monthly payments or paying in a lump sum.

Some stocks and shares isas will invest in a small number of funds others will let you choose between thousands. There are five main types of isa cash isas help to buy isas innovative finance isas stocks shares isas and lifetime isas. If you don t understand a financial product get independent financial. Dividend tax if you buy shares or collective investments such as unit trusts that invest in a portfolio of shares for you you re likely to receive dividends.

This can be invested in cash or stocks and shares or a combination of both. More potential for returns than a cash isa and a tax efficient way to save.